2022 Corporate Insolvencies Soar 56% What now?

The huge swathe of corporate insolvencies we seen throughout 2022 are continuing to wreak havoc for businesses across the UK.

The Office for National Statistics (ONS) have just released the monthly insolvency statistics for December 2022 and they make for some stark reading, with the number of corporate insolvencies recorded for the month across England, Scotland and Wales (2,078) 31% higher year on year (1,581) and a colossal 72% higher than 2019 pre-pandemic numbers (1,209).

With 2,078 corporate insolvencies taking place in the month of December 2022 in England, Scotland and Wales this takes the total number of the year to 23,180. Compare this figure to 14,812 recorded in 2021 (an increase of 56%) and 18,233 recorded before the pandemic in 2019 (an increase of 27%) and we see we are on a collision course with disaster for UK businesses.

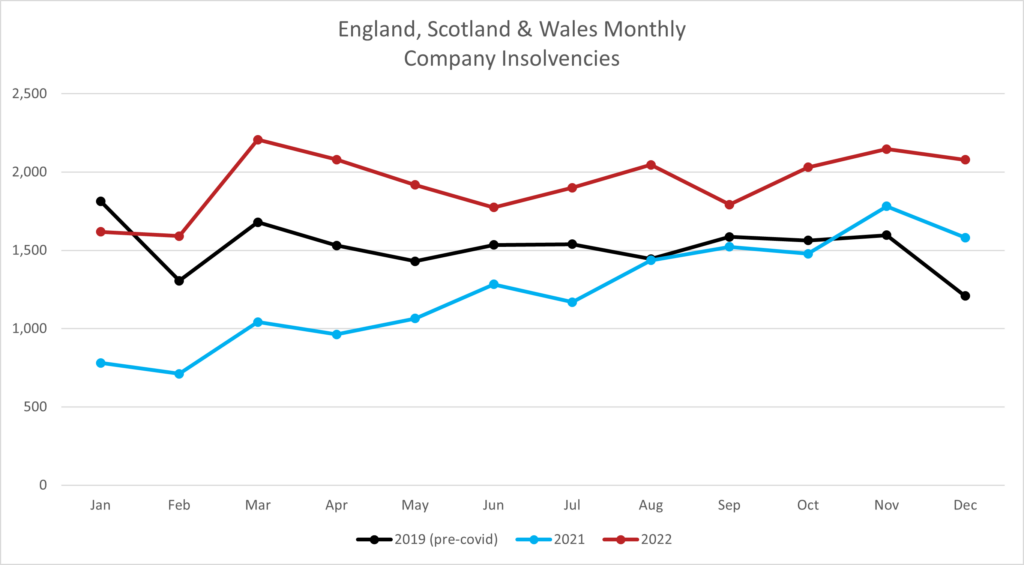

Below is a breakdown of monthly insolvency figures for 2022, 2021 and 2019:

As we can see in the chart above, after January last year the number of 2022 corporate insolvencies are consistently higher than last year, which was to be expected, but also far higher than pre-pandemic levels.

Throughout the first half of 2022 we always expected the number of corporate insolvencies to be higher than 2021 since the temporary ban on issuing winding up petitions was still in place to protect businesses from the impact of the COVID-19 pandemic. However, as we previously reported back in March 2021, these measures essentially kept many businesses on life support, the businesses that would have folded regardless of the pandemic.

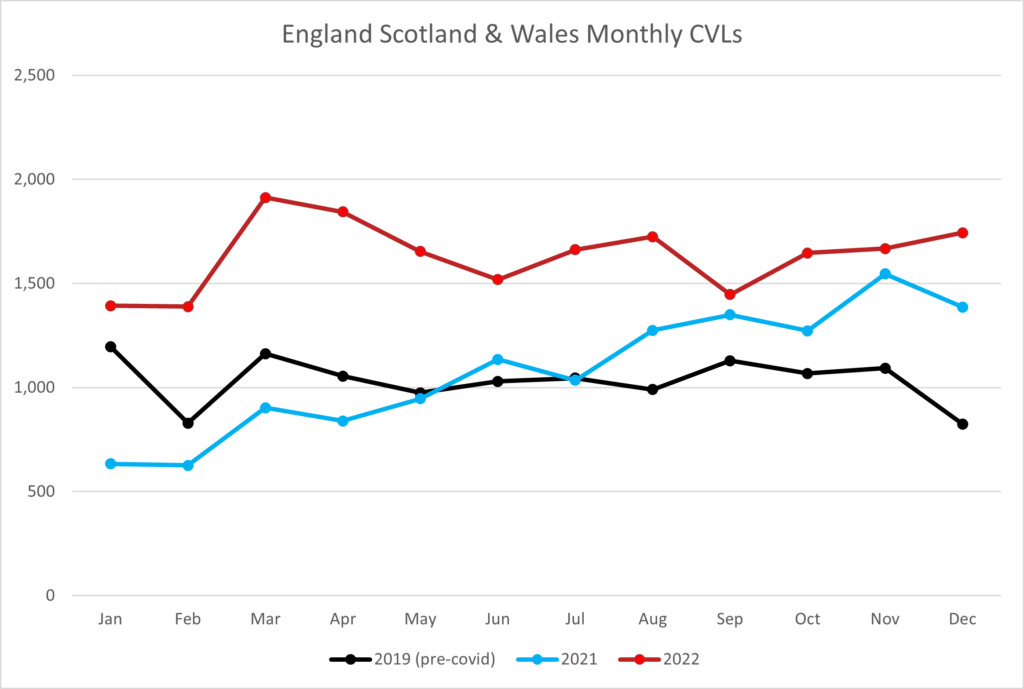

Creditors’ Voluntary Liquidations (CVLs)

The dramatic spike in Creditors’ Voluntary Liquidations (CVLs) is very telling of the current landscape for businesses in the UK.

19,604 CVLs were recorded in 2022, a rise of 58% from 2019 (12,397) and 51% since 2021 (12,946).

This data is extremely relevant because a CVL is when a business is placed into liquidation to pay their outstanding debts. In November 2022 it was reported that late payments for businesses hit a two-year high. The credit cycle is extremely delicate, once businesses have difficulties paying invoices the knock-on effect to other firms can be disastrous, putting many businesses at risk of closure.

What now?

With the UK already in a recession that is expected to last until the end of 2024 it is critical that businesses do all they can to keep a healthy cashflow as both consumers and businesses tighten their purse strings.

Failure to do so, especially if payments are not forthcoming, will result in a very long couple of years. That’s if a struggling business survives that long.

We can not stress enough the importance of not being complacent. Even if you do not think your own business is at risk of insolvency there could be a very high likelihood that your clients might be, looking at recent data. If you have clients that are insolvent you will need to attract more clients to make up for this void, but if your insolvent clients have unpaid invoices there is a high likelihood that you will lose out on cash you are owed.

How businesses can protect themselves from the tsunami of corporate insolvencies

Implementing robust credit control processes is key to ensuring you are paid on time and makes it far easier to maintain a healthy cashflow, especially against the backdrop of soaring costs and interest rates we have seen over the past 12 months.

Here are three steps businesses can start taking today to mitigate the risk of defaults on payment, get a firmer grasp of their credit control processes and ensure they are paid promptly:

1.) Credit check all new and existing customers when a new order is placed.

Businesses should understand their clients’ credit worthiness, track record of payments and any CCJs you need to be aware of.

A business credit report will give you all of the data you should need to make an accurate well-informed credit decision including company credit score and suggested credit limit.

Get a free company credit report from our partner Know-it today!

2.) Be proactive chasing payments

As your payment date approaches it is always worth sending a polite reminder to your client that payment is due soon. This will bring your invoice to the front of their mind and make sure your invoice is not forgotten about.

If your payment date passes and no payment is made all businesses need to have a series of payment chasers prepared and ready to send.

We’d recommend sending your 1st reminder within 48 hours of your payment due date, a 2nd reminder 7 days after your payment due date, a 3rd chaser if payment is still not made within 30 days and a 4th and final reminder threatening further action if more than 30 days pass and there has been no update.

3.) Have a back-up plan for recovering overdue accounts

In the event your payment reminders and chasers go unanswered you must have a back-up plan and be ready to call in reinforcements to recover what you are owed.

The warning signs that a client is not going to pay are clear when you know what you are looking for.

Here at Darcey Quigley & Co we’ve been recovering unpaid invoices from around the world for the past years. Believe us when we say there is not an excuse we have not heard or and scenario we have not dealt with before.

Why choose Darcey Quigley & Co

- Excellent track record – rated 5 stars on Trustpilot.

- UK & International commercial debt recovery

- All cases actioned within 1 hour with a 48 hour turnaround.

- 93% success rate recovering overdue invoices.

- Fees starting from just 3%.

- Risk free debt recovery – only pay a fee if your invoices are successfully recovered.

- Recover late payment interest & compensation on top of your outstanding amounts.

- Live case updates online with our new client portal.

Take action today to recover any overdue amounts you are owed and protect your business cashflow as we navigate choppy seas through 2023 against the tide of soaring insolvencies and a shrinking economy.

Schedule a call with a debt recovery specialist and begin recovering your unpaid invoices.

Lynne is the Founder and CEO of Darcey Quigley & Co.

She is passionate and determined to help businesses get overdue invoices paid quickly.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 18 years, Lynne has helped businesses recover commercial debts from every continent across the globe.

Connect with me on LinkedIn!