Everything You Need To Know About Unpaid Invoices

Update June 2023: With interest rates continuing to soar we’ve updated this guide to reflect the most recent changes to the amount of late payment interest you’re legally entitled to.

Unpaid invoices are decimating businesses across the UK against the backdrop of soaring company insolvencies.

Late payment of invoices are a serious problem threatening the existence of thousands of businesses across the UK. The value of unpaid invoices has rocketed 22% to £61 billion in just a year and in November 2022 late payments for small businesses hit two-year high.

Unpaid invoices are a very real hazard that businesses must mitigate. If they don’t then there is a serious risk that they could become one of the 50,000 UK businesses that fail every year due to not being paid on time.

Are you making some common mistakes that lead to unpaid invoices? Find out how to avoid them here!

As you are reading this it’s highly likely that you are facing problems caused by unpaid invoices or have done previously.

Given the severity of the late payment crisis impacting so many businesses we have put everything you need to know about unpaid invoices into this guide so you are better equipped to deal with late payments, get your invoices paid quicker and improve your cash flow.

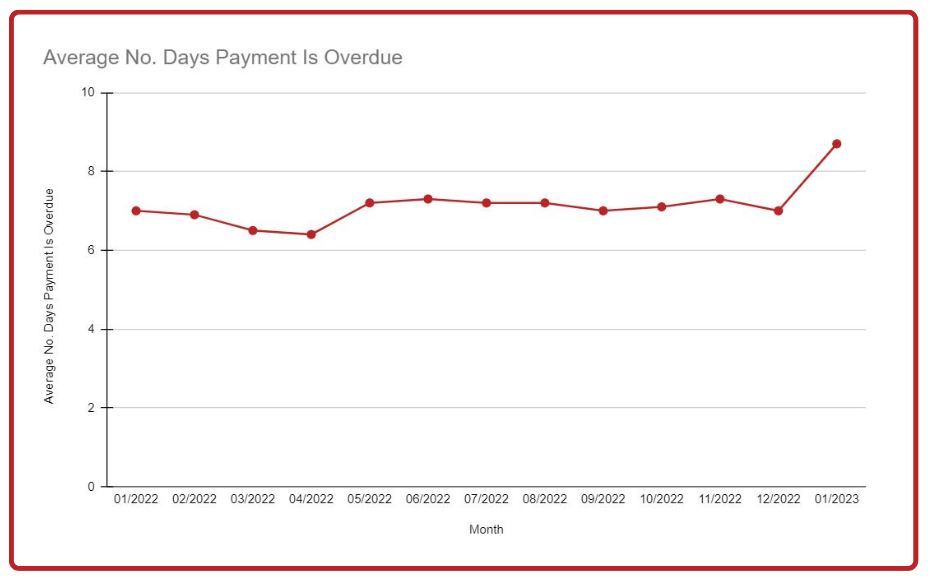

Worrying trend in overdue payments

The average number of days that payment is overdue seen a sharp rise as we entered 2023.

It’s feared this trend is set to continue as the UK faces a recession some expect to last until 2024.

How to deal with unpaid invoices

Unpaid invoices are restrictive and can paralyse your business. Any blockage to your cashflow means you have less capital to reinvest to grow your business and in worst cases, as we’ve discussed, it can threaten the very survival of your company.

When an invoice isn’t paid on time follow this checklist to maximise the chances of receiving the cash you are owed:

- Send payment reminders just before payment is due.

- Be proactive chasing unpaid invoices.

- Have a plan to recover unpaid invoices.

- Add late payment interest & compensation.

- Be flexible, where possible, with payment plans.

- Keep a clear paper trail of all communication regarding your unpaid invoice.

- Utilise all communication channels so your invoice can not be ignored.

We’ve broken down the more complex steps below so you know exactly how to deal with unpaid invoices.

How to chase unpaid invoices

Unfortunately chasing your unpaid invoices isn’t as simple as asking for payment once.

To have success in getting your overdue invoices paid it is critical you have a payment chasing schedule set up, and always send a polite payment reminder just before your payment due date.

Sending payment reminders

A polite payment reminder will keep your invoice at the front of your client’s mind.

Your tone should always be friendly when sending a payment reminder as you don’t want to upset one of your customers and risk them not doing business with you again.

The best way to send a payment reminder is by email, and it should be concise and to the point.

A tip we’d recommend is to include your company name, invoice number and the due date in the subject line so your customer can see when your invoice is due to be paid just by glancing at their inbox and always attach the invoice you are referring to, to save your customer trawling back to find it.

Invoice chasing schedule

Having a schedule and pre-written chasers for your unpaid invoices is a lifeline that will make you more proactive in chasing late payments, help get more invoices paid quicker and save you time!

Here’s a tried and tested invoice chasing schedule that will ensure you are paid quicker:

1st unpaid invoice chaser

It always pays to be proactive chasing your unpaid invoices so your 1st payment chaser should be sent a day after the date payment was due.

Giving 24 hours after the payment due date is a reasonable amount of time to wait before beginning to chase your outstanding amount.

As this is your first chaser and not a lot of time has passed from your payment date your message should be polite advising when payment was due and asking your customer first if they have received your invoice and secondly when you can expect to receive payment.

In some rare cases payment is not made because the invoice was not received. This is why we recommend always attaching your invoice to every piece of correspondence relating to that particular invoice.

2nd unpaid invoice chaser

If a full week passes after your due date and payment still hasn’t been received and you’ve had no update from your customer it’s time to send your 2nd chaser.

You should take a slightly firmer approach with this chaser but whilst it can become increasingly frustrating waiting for payment, remember to remain courteous in your approach.

With this chaser you should be asking if there is anything delaying payment being made such as a query about the invoice, errors on the invoice or issues at your customer’s end.

Queries and mistakes on an invoice hold up payment so it’s critical you get these resolved as soon as possible.

3rd unpaid invoice chaser

If you have an unpaid invoice that’s 30 days overdue then it’s time to take things further.

This is when you emphasise a sense of urgency and the invoice must be paid immediately.

An effective lever to pull is threatening to add late payment interest and compensation on top of the outstanding amount. No business wants to spend more than they need to so this is often effective in getting your customer to pay up.

Not sure what late payment interest and compensation is? Don’t worry, we’ve included everything you need to know further on in this guide!

Final demand

In the most extreme cases, where an invoice goes unpaid for more than 30 days after the due date you must make it clear that this is the final reminder you are sending.

Include this in the subject line, as well as the invoice number and your company, as well as in the body of the email.

With your final demand you should be stating how late the invoice is and if payment is not made immediately you’ll have no other option but to take further action, such as getting a commercial debt recovery specialist to step in and recover payment.

This email should be a last attempt from you to try and recover the money on your own as if you fail to follow up and get a debt recovery partner involved all further communications from you won’t be taken seriously.

Utilise all communication channels

When chasing unpaid invoices it is imperative that you utilise all communication channels so you can not be ignored.

Contacting your customer by email, phone calls, SMS or an app such as Whatsapp will get their attention. Your final demand should also be sent via post as a final attempt to encourage payment.

How to recover unpaid invoices

With more problematic cases some businesses think they can avoid paying, even after accepting the work you’ve carried out or products you have supplied.

Having recovered unpaid invoices for business for the past 16 years we have heard every excuse in the book when it comes to companies not paying invoices and there is nothing we have not seen.

The power of outsourcing your commercial debt recovery should never be underestimated. Receiving an official notice from a firm such as Darcey Quigley & Co can often be all that’s needed to recover your unpaid invoices.

Our commercial debt recovery process ensures you are paid quickly and efficiently with minimal fuss, allowing you to focus on other areas of your business.

Having a back up plan with a reputable debt recovery partner is vital when you come across a client who continually avoids paying outstanding invoices, and sometimes can be the only viable way for you to recover the outstanding amount you are owed.

Can I take my case to court?

Taking your unpaid invoices down the legal route and going through the court system is a possibility.

However, it is very time-consuming. Court cases can take months for a hearing to even take place. There is still a backlog in the UK court system so timescales are even longer than before.

It is also an extremely expensive route to take. When legal and court fees are taken into account you are leaving a lot of cash on the table.

Here at Darcey Quigley & Co our fees start from just 3%! See a full breakdown of our fee structure here.

We also action cases within 1 hour with a 48 hour turnaround!

Can I add late payment interest to an unpaid invoice?

Yes, The Late Payment of Commercial Debts Act means you are legally entitled to add late payment interest to your unpaid invoices.

We discussed earlier in this guide that you could threaten to add this in your third payment chaser, but you can add this as soon as your invoices becomes overdue!

If your invoice does not specifically state payment terms, then an invoice is officially deemed overdue after 30 days.

The continuous increases in interest rates over the past few months means there has never been a better time to add late payment interest to your overdue invoices!

How to calculate late payment interest

There is a set percentage that you are legally entitled to charge – 8% PLUS the Bank of England base rate for business to business transactions which currently sits at 5%.

This means 13% of the invoice value is the amount of late payment interest you can charge.

Here’s an example:

a £10,000 invoice overdue by 90 days:

If your business is owed £10,000 then the annual statutory interest would be £1,300.00.

Divide £1,300 by 365 to get the daily interest, which would be £3.56164383562

£3.56164383562 daily interest multiplied by 90 days gives £320.55

£320.55 would be the statutory interest that could be added to a £10,000 invoice overdue by 90 days.

How much compensation can I claim for my unpaid invoices?

Changes to The Late Payment of Commercial Debts Act means you are also eligible to compensation on your late, unpaid invoices.

The compensation that can be claimed is broken down as follows:

£40.00 on debts under £1,000.00

£70.00 on debts under £10,000.00

£100.00 on debts £10,000.00 and over

As each individual invoice is classed as a debt the compensation can be claimed on each invoice.

Additional reasonable costs can be claimed if the costs of debt recovery are not met by the compensation.

Get a free quote and see exactly how much you are entitled to claim

Here at Darcey Quigley & Co we always strive to recover late payment interest, compensation and reasonable costs for debt recovery on top of your full outstanding amount owed, all from your customer.

We have an 89% success rate recovering these additional costs on your behalf!

Use our free calculator to find out exactly how much late payment interest, compensation and reasonable costs you are entitled to, and if you’re happy, you can upload your invoices right away and our team will action your case within an hour!

Steps you can take to help avoid unpaid invoices in future

Unpaid invoices are an incredibly frustrating part of doing business when they arise.

Thankfully there are steps you can take to minimise the risk of late payments occurring by following a structured credit control process.

Know your customer with company credit checks

Knowing your customer and understanding how much of a credit risk they could pose to your business is the very first step you should take when it comes to credit control.

A good company credit report will give you a credit score, recommended credit limit to offer, their track-record of making payments, any defaults on payment and anything else you should be aware of such as CCJs.

Once you have all of this information to hand you will be able to make a well-informed credit decision.

Whenever you take a new order, whether from a new client or existing customer you should always pull a new company credit report. Credit scores and limits are always changing so you must make decisions using the most up to date information.

Collect payment up front for customers that pose highest credit risk

For customers that are deemed a risk to issue credit for, you can always ask for payment up front to avoid the need to chase an unpaid invoice at a later date, after you have already delivered product or a service.

Use an invoicing platform and accountancy package

Using a dedicated invoicing platform coupled with a digital accountancy packages makes it easy to track invoices, understand who your aged debtors are and easily keep track of payments received.

This way you can see instantly who owes your company money so you can take necessary action quicker, resulting in faster payment!

Take action on your unpaid invoices

The longer you leave unpaid invoices overdue the harder they become to recover.

Our advice is to take action sooner rather than later.

If you’d like a free consultation with our commercial debt recovery and credit management specialists, book a call at a time that suits you!

Why you should consider Darcey Quigley & Co for recovering unpaid invoices

- We operate on a no win, no fee basis.

- Cases actioned within 1 hour with 48 hour turnaround.

- 93% success rate recovering overdue invoices.

- Fees starting from just 3%.

- Recover late payment interest and compensation on your behalf with an 89% success rate recovering additional charges.

- UK & International coverage.

- Rated 5 Stars on Trustpilot.

Lynne is the Founder and CEO of Darcey Quigley & Co.

She is passionate and determined to help businesses get overdue invoices paid quickly.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 18 years, Lynne has helped businesses recover commercial debts from every continent across the globe.

Connect with me on LinkedIn!