The Transformative Role of Technology in Debt Recovery

Debt recovery has always been a challenging and time-consuming process for many businesses, no matter their size.

However, with advancements in technology, the landscape of debt recovery has undergone a significant transformation.

Today, technology plays a crucial role in streamlining and optimising the debt recovery process, making it more efficient, accurate, and cost-effective.

In this article, we will explore the various ways in which technology has revolutionised debt recovery.

Live case updates online

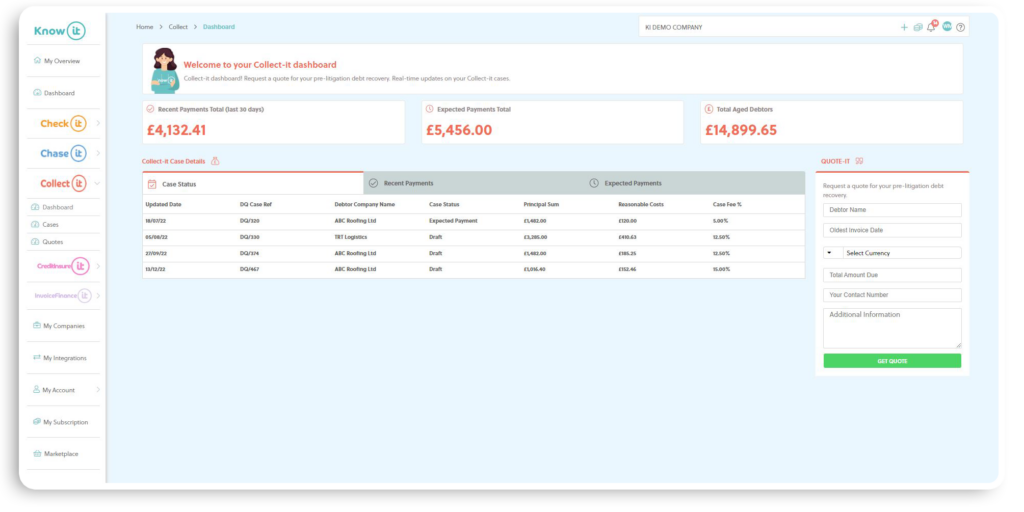

When you instruct Darcey Quigley & Co you will have access to your own online platform where you’ll be instantly notified of updates to your debt recovery case.

This is because we’ve partnered with Know-it, the all-in-one credit control platform that helps businesses streamline the complete credit control process.

Of course, we’re always on hand to discuss your case in more detail over the phone, but now you can see the progress of your case at a glance instead of waiting by the phone for an update.

Darcey Quigley & Co are Know-it’s commercial debt recovery partner meaning all cases actioned through the platform are handled by us.

Data management and analytics

One of the primary challenges in debt recovery is dealing with large volumes of data related to customers you have issued credit to, outstanding amounts, and payment histories.

Manual handling of such data can be error-prone and time-consuming.

However, technology solutions such as customer relationship management (CRM) systems and data analytics tools have revolutionized the way creditors manage and analyse debt-related data.

CRM systems enable creditors to store and organise customer information, track interactions, and monitor payment histories.

By leveraging data analytics tools, financial institutions can gain valuable insights into customer behaviour patterns, identify high-risk accounts, and prioritise debt recovery efforts.

These technologies provide you with a holistic view of your debt portfolio and aged debtors, enabling you to make informed decisions and optimise your debt recovery strategies.

Automated communication

Traditional debt recovery processes often involve multiple manual communications, such as letters, phone calls, and in-person visits.

These methods were not only time-consuming but also led to inconsistent results. Technology has introduced automated communication tools that streamline and standardise the debt recovery process.

Know-it enables you to automatically send automated payment reminders and chase unpaid invoices using fully customisable emails, SMS and letters.

This not only saves time and ensures you keep on top of late payments, but also helps you avoid sometimes difficult conversations with clients when chasing payment.

Online payment systems

The advent of online payment systems has revolutionised the way debtors settle their outstanding balances.

Traditional payment methods, such as cheques and money orders, often involved delays, errors, and additional costs. Online payment systems provide debtors with convenient and secure channels to make payments, eliminating the need for manual processing.

These systems enable you to offer various payment options, such as credit/debit card payments, electronic fund transfers, and mobile wallet payments.

The ease of making payments online encourages debtors to settle their debts promptly, resulting in your business getting paid quicker!

Additionally, online payment systems can be integrated with your accountancy package, enabling real-time updates and automated payment reconciliation.

Upload invoices and action a debt recovery case in seconds

Our free calculator will tell you exactly how much late payment interest, compensation and debt recovery costs you can legally claim from your debtor.

If you are happy with the amounts, you can upload your overdue invoices and action your case with us immediately.

Conclusion

Technology has undoubtedly revolutionised the debt recovery process, empowering creditors with advanced tools and capabilities.

From data management and analytics to automated communication and online payment systems, technology has significantly enhanced the efficiency, accuracy, and cost-effectiveness of debt recovery efforts.

While the adoption of technology in debt recovery has brought about many benefits, it is crucial to strike a balance between automation and personalised human interaction.

A thoughtful combination of technology and human expertise can optimise the debt recovery process, improve customer experience, and ensure sustainable financial outcomes for both creditors and debtors.

Here at Darcey Quigley & Co we keep ourselves at the forefront of new technologies in commercial debt recovery to ensure we deliver the best service possible.

Are you having problems with debt recovery?

Darcey Quigley & Co are here to help you every step of the way with our unique approach to commercial debt recovery.

Our tried and tested process ensures you are paid quickly without sacrificing the relationship you have with your client.

- We operate on a no win, no fee basis.

- Cases actioned within 1 hour with 48 hour turnaround.

- 93% success rate recovering overdue invoices.

- Fees starting from just 3%.

- Recover late payment interest and compensation on your behalf with an 89% success rate recovering additional charges.

- UK & International coverage.

- Rated 5 Stars on Trustpilot.

If you have questions about a business debt schedule a call with one of our commercial debt specialists here or phone 01698 821 468.

Lynne is the Founder and CEO of Darcey Quigley & Co.

She is passionate and determined to help businesses get overdue invoices paid quickly.

Having worked within the credit management industry for over 27 years and ran UK leading commercial debt recovery specialists Darcey Quigley & Co for over 18 years, Lynne has helped businesses recover commercial debts from every continent across the globe.

Connect with me on LinkedIn!